(2014)

1. I Pay myself First

No matter how much money I make at a particular time, I’ve always paid myself first. My salary is automatically transferred to 5 different bank accounts where I manage my 6 financial accounts, namely GIVE, MOM, Personal Development, Traveling & LTSS, PLAY and Financial Freedom.

2. I’d have unlimited Budget for Food & Hobbies*

I used to eat less to save for entertainment & shopping while in University. After a while, I realized it became an unhealthy habit. I didn’t want to starve myself anymore! I’m grateful that money is now hardly a deciding factor for me when it comes to dining 🙂

Though I’m still not able to eat whatever I want at wherever I want now, I WILL soon. I don’t want to eat “chicken” forever.

3. I believe Giving is Receiving

4. I Invest on myself

Brian Tracy says the best investment one can make is on themselves. Books, seminars, courses, meet-ups… whatever could help me learn more. I’ll make sure I equip myself with good knowledge and experience.

5. I buy Experience, not Things

What a saying! What a lesson! Instead of buying a big Television, I’ll rather spend it on a private event or traveling. Eventually, my life is all about my experience and stories (memories) not about what I’ve bought (diamonds). As a matter of fact, I hardly remember what I bought last year. It doesn’t matter at all. Things don’t last; experience does!

Buy Experience, Not Things”

In 2015, I spent around S$4,000 for traveling (in which roughly $2,000 was for my trip to China). It’s quite a lot but I believe it’s worth it!

(Updated in 2015)

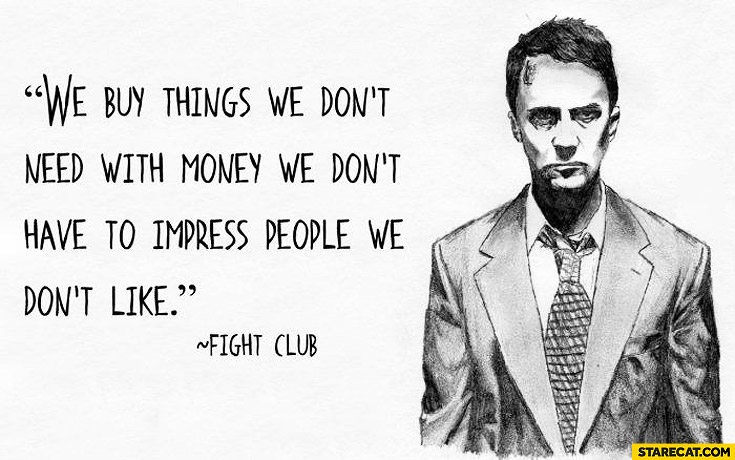

Buy to Use; not to Impress

One of the main reasons I bought consumer products apart from necessity is to impress others (a decent & functional but unpopular watch vs a Rolex). That tends to make me to buy unnecessary stuff as well.

6. I’m not a cheapskate

Having said that, when I do shop, I will buy superior (and therefore usually expensive) products. I learn this lesson through personal experience. Inferior products will have to be replaced much sooner than superior ones [EXPERIENCE]. Besides and more importantly, two or even three cheap Xs usually cost more than one expensive Y. I’d waste time looking for them as well.

As wallet and watch are as important to a man as bags and shoes to women, I’m willing to spend big on them (refer to the rule 4). My ex-girlfriend also said shoes are one of the things you wear everyday and often, I should get a good one as well.

Periodically Shopping for Diversity

Even superior products if used everyday wouldn’t last long [EXPERIENCE]. And to make sure I don’t look too boring, I’d shop periodically for diversity. For example, two new t-shirt every 2 or 3 months will make sure I won’t run into the shortage of clothes situation. “I shop for what I’ll need” is totally different from “I shop before I need”. So do “Buy 2 every 2 months” vs “Buy 4 at a time”. When it comes to shopping, this equation works perfectly for me:

Superior Products + Periodically Shopping = Time & Money Saving

7. I always Negotiate

I try to negotiate everything. As mentioned, I negotiate not necessarily for the sake of money alone but to build a good habit to getting Great Deals in both life and business. I learn that I can get a better deal than what is presented in most cases.

I used to say “- it’s OK” though I know the product’s significant overpriced. “- It doesn’t matter much!” (as hundreds in weaker currencies are sometimes worth only a few cents). But in fact, it does (habits):

The way you do anything is the way you do everything!” – T. Harv Eker

Ask. The worst thing could happen is a “No” from them.

> Invest (in progress)

Saving without investing is a curse. In fact, it’s why most people are struggling financially.